Improving Your Company Benefits Package Without Increasing Cost: Part 3

For many U.S. employers, offering health insurance as a company benefit is now a legal requirement. However, for those companies smaller than 50 full-time-equivalent employees, the decision to offer benefits – and generous, high quality benefits at that – can be one of the best business decisions you ever make. However, the cost can be prohibitive. This series takes a look at ways to continue to improve your benefits package without substantially increasing your costs – and in some cases, decreasing your costs.

Method #3: Add FSA Plans

Flexible spending accounts allow employees to set aside pre-tax dollars to pay for various expenses. This is a low-cost benefit for the employer: you are often paying a one-time implementation fee and a low per-employee-per-month flat fee (a few dollars for each employee). FSA accounts are desirable for high–income employees as they bring their taxable income down. They are also particularly helpful for employees with medical issues that are not entirely covered by their insurance. FSA accounts go beyond just paying for healthcare though; you can set up any of the following types of FSA accounts (many employers choose to offer all four):

- Parking FSA – Employees can put aside up to $255 monthly toward parking expenses

- Commuter/Transit – Employees can put aside up to $255 monthly toward transit costs, such as train fare

- Healthcare FSA – Employees can put aside up to $2,600 annually to cover medical costs aside from insurance premiums, such as doctor visit copays, contact lenses, dental bills, etc.

- Dependent Care FSA – Employees can put aside up to $5,000 annually to pay for day care expenses for their children

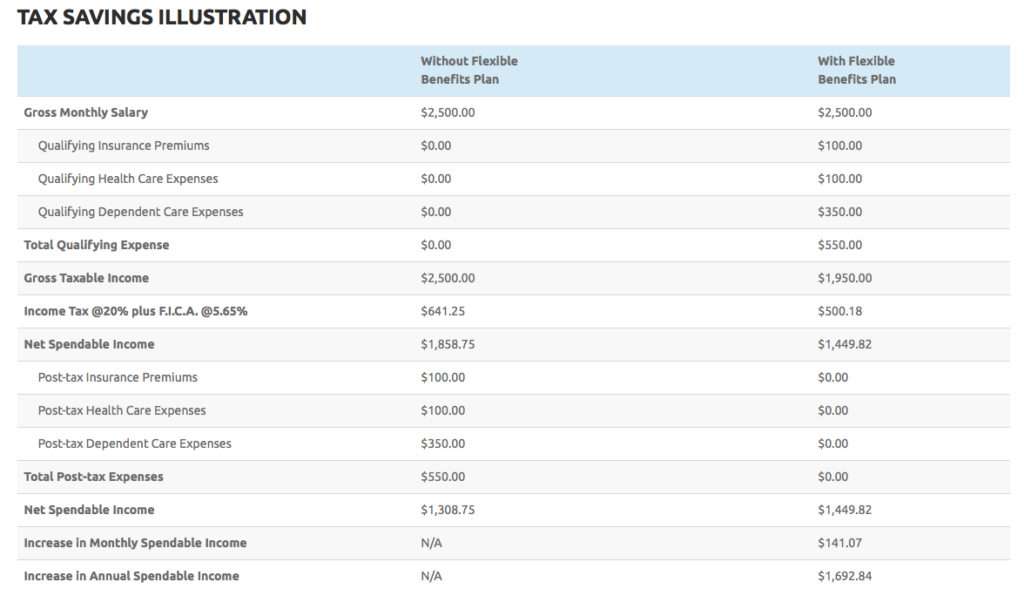

Below is an example from ASI Benefits of how an FSA plan can help manage health & dependent care costs AND bring down taxable income:

Throughout this series you will find 5 methods to improve your benefits package – but each company is different and may have unique needs. Please feel free to reach out directly for a complimentary benefits evaluation to review specific ways your company can improve your benefits package and save money in the process:

Ingrid Greger

Benefit Experts Insurance Agency

Ingrid@benefitexperts.com

650.251.4228